Multiply that result by 100 to see the percentage change — in this case, 21.3%. Again, a positive number indicates growth, and a negative number indicates a decline. In this example, take $2.395 billion and subtract $1.975 billion; the result is $420 million. That means that ABC Company increased its total assets by trump proposes eliminating payroll tax through the end of the year $420 million during this one-year period. A debt-to-equity ratio of 2.0 means that for every dollar of equity, there are two dollars of debt. This ratio indicates that the company is significantly leveraged, which may pose risks, especially if interest rates increase or if the company faces a downturn in revenue.

- Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet.

- In studying Analyzing Balance Sheets for the CFA Exam, you should learn to understand the components and structure of a balance sheet, including assets, liabilities, and equity.

- For this reason, a balance alone may not paint the full picture of a company’s financial health.

- Balance sheets can be used with other important financial statements to conduct fundamental analysis or calculate financial ratios.

Factor in additional financial statements

Assets are anything the company owns that holds some quantifiable value, which means that they could be liquidated and turned into cash. Some liabilities are considered off the balance sheet, meaning they do not appear on the balance sheet. Your job as an analyst is to connect the numbers to the real-world factors driving the business.

Everything You Need To Master Financial Modeling

That is, assets are on the left; liabilities and stockholders’ equity are on the right. With a greater understanding of a balance sheet and how it is constructed, we can review some techniques used to analyze the information contained within a balance sheet. This means that assets, or the means used to operate the company, are balanced by a company’s financial obligations, along with the equity investment brought into the company and its retained earnings.

Current Assets

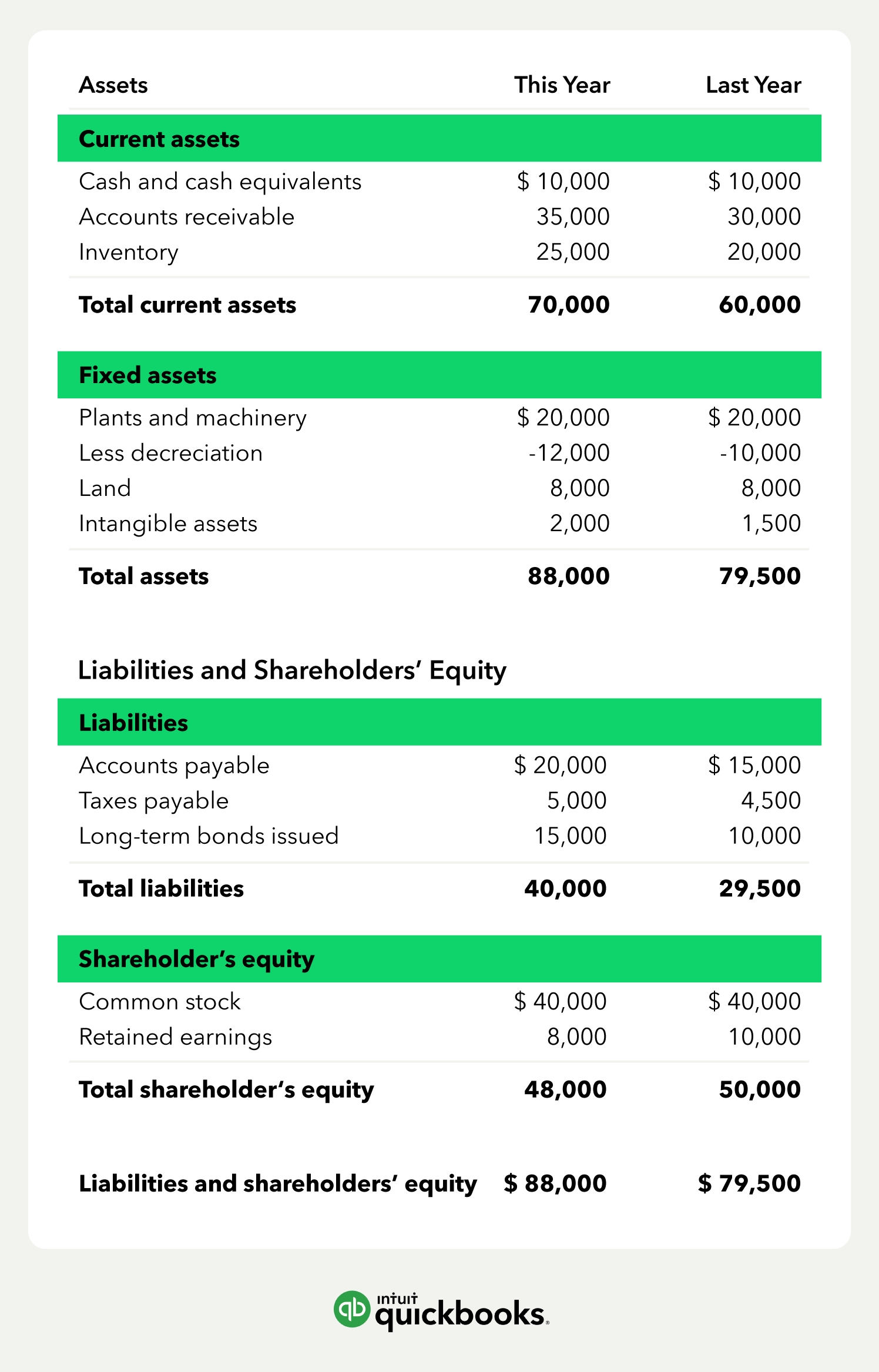

As noted above, you can find information about assets, liabilities, and shareholder equity on a company’s balance sheet. The assets should always equal the liabilities and shareholder equity. This means that the balance sheet should always balance, hence the name. If they don’t balance, there may be some problems, including incorrect or misplaced data, inventory or exchange rate errors, or miscalculations. On a more granular level, the fundamentals of financial accounting can shed light on the performance of individual departments, teams, and projects. Whether you’re looking to understand your company’s balance sheet or create one yourself, the information you’ll glean from doing so can help you make better business decisions in the long run.

Financial Strength Ratios

Annie’s Pottery Palace, a large pottery studio, holds a lot of its current assets in the form of equipment—wheels and kilns for making pottery. You can improve your current ratio by either increasing your assets or decreasing your liabilities. Ecord the account name on the left side of the balance sheet and the cash value on the right. On the other hand, long-term liabilities are long-term debts like interest and bonds, pension funds and deferred tax liability.

A company’s balance sheet is one of three financial statements used to give a detailed picture of the health of a business. Investors and analysts will read the balance sheet alongside the income statement and cash flow statement, to evaluate the company’s overall financial position. The balance sheet includes information about a company’s assets and liabilities. Depending on the company, this might include short-term assets, such as cash and accounts receivable, or long-term assets such as property, plant, and equipment (PP&E). Likewise, its liabilities may include short-term obligations such as accounts payable and wages payable, or long-term liabilities such as bank loans and other debt obligations.

In both formats, assets are categorized into current and long-term assets. Current assets consist of resources that will be used in the current year, while long-term assets are resources lasting longer than one year. On a balance sheet, assets are usually described starting from the most liquid, through to those long-term assets which may be more difficult to realise. Let’s take a look at the type of assets which feature on a balance sheet. As the name suggests, the equation balances out, with assets on the one side being equal to the sum of liabilities and equity on the other. Some companies issue preferred stock, which will be listed separately from common stock under this section.

Comparing several years of a company’s balance sheet may highlight trends, for better or worse. And note that most online brokers—and several financial data platforms freely available online—publish the top ratios for you, making them easy to track. To ensure the balance sheet is balanced, it will be necessary to compare total assets against total liabilities plus equity.

If there are discrepancies, that means you’re missing important information for putting together the balance sheet. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

For this example, we’ll use this hypothetical balance sheet of ABC Company, an industrial manufacturer. The table below summarizes the company’s assets for the past two year-end periods. Liabilities are amounts a company owes to someone else, either immediately or over a long period. One way to own a more expensive asset is by taking out a loan to pay for it, which would increase a firm’s liabilities. It’s not uncommon for a balance sheet to take a few weeks to prepare after the reporting period has ended.

Leave a Reply